We are fortunate to be living in a new era of capitalism where we can all invest in early stage deals accessible until just recently only to sophisticated angel investors ($20 billion) and venture capital funds ($50 billion). But the biggest shift in the $1.2 Trillion worth of private placements is towards the online distribution model, called crowdfunding.

Traditional VC money started being “disrupted” on April 5, 2012 when President Obama signed the Jumpstart Our Business Startups (J.O.B.S.) Act in order to change outdated investor laws made in 1933 after the Great Depression.Now, four years later the new laws have forever changed the way entrepreneurs raise funding and who has access to invest in startups.

Jumpstart Our Business Startups (J.OB.S.) Act, Public Law 112-106 (22 pages)

Signed by President Obama on April 5, 2012

The summary titles of the bill are:

- TITLE I - Reopening American capital markets to emerging growth companies

- TITLE II - Access to capital for job creators

- TITLE III - Crowdfunding

- TITLE IV - Small company capital formation

- TITLE V - Private company flexibility and growth

- TITLE VI - Capital expansion

- TITLE VII - Outreach on changes to the law or commission

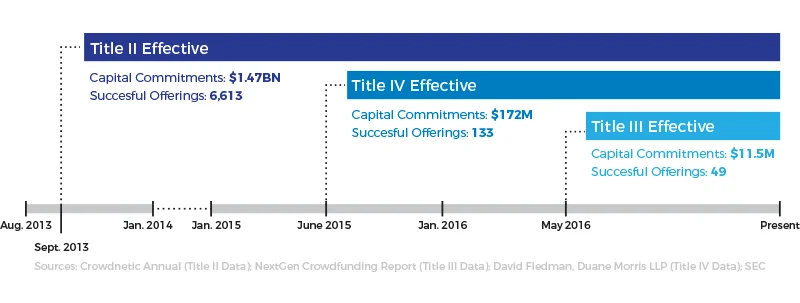

Below are some interesting statistics about the three most popular equity crowdfunding paths:

- Title II (accredited): effective Sept 2013, 6,613 offerings, $1.47 billion in capital commitments

- Title III (non-accredited): effective May 2016, 49 successful offerings, $11.5 million raised

- Title IV (non-accredited): effective June 2015, 133 offerings filed, $172 million raised